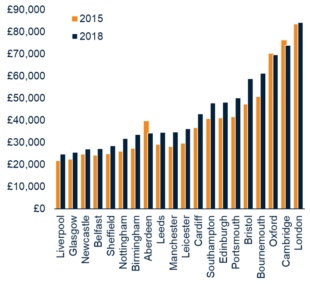

House price inflation pushes up income required to buy a home up by almost a quarter since 2015

– The income first-time buyers need to get on housing ladder in UK’s 20 largest cities has shot up 18% in the past three years and by as much as 24% in Bristol

– Buyers required an average income £53,000 to afford a home – this ranges from £25,000 in Liverpool to £82,000 in London

– UK city house price growth +3.9 % in the past year, driven by faster growth rate in most affordable cities – Liverpool (+7.5%) and Glasgow (+7.2%)

The minimum income first-time buyers need to purchase a home in the UK’s largest cities has rocketed by 18% in the past three years, according to the latest Hometrack UK Cities House Price Index.

New figures show first-time buyers need to earn, on average, £53,000 to buy a home in the UK’s 20 largest cities, up 18% from £45,000 just three years ago. The income to buy ranges from £25,000 in Liverpool to £82,000 in London.

Figure 1 – First time buyer – income to buy outright

Source: Hometrack calculations

The data highlights how house price growth has outstripped wages over the past three years, pushing the dream of homeownership further out of reach for those households on lower incomes. Hometrack’s UK city index shows how house prices have risen by an average of 14.5% over the last three years, whereas average wages have grown by just 7.5% to £489 a week over the same period, according to the Office for National Statistics.

Figure 2 – House price growth – % Yoy current v 12 months ago

Source: Hometrack UK Cities Index

Buyers in Bristol and Manchester must now earn a minimum of £58,826 and £34,770, respectively, to get on the housing ladder – a 24% increase in three years.

The situation is not much better for buyers in Birmingham, Nottingham and Leicester, where the income required to get on the housing ladder has shot up by 23% since 2015.

Buyers in Aberdeen, on the other hand, now need just £34,262 to buy their first home – down £5,388, or 14%, compared to three years ago. This is because house prices in the Scottish city have fallen 17% to £164,800 in that time.

Overall, house prices in the UK’s largest 20 cities have grown by an average of 3.9% in the year to August. The fastest growing cities are the most affordable. Liverpool and Glasgow are registering price growth of 7.5% and 7.2%, respectively, over the past year.

Price growth is weakest in the most unaffordable cities along with Aberdeen. Just three cities experienced price drops in the year to August – Cambridge, London and Aberdeen, falling by 0.1%, 0.3% and 3.7%, respectively.

Richard Donnell, Insight Director at Hometrack, says: “

“House price growth continues to outpace earnings across 16 of the 20 cities covered by the index as buyers continue to bid up the cost of housing on the back of low mortgage rates and high levels of employment. The fastest growth is being recorded in the most affordable cities where prices are rising off a low base”.

Donnell adds: “Cities like London and Cambridge require the highest incomes to buy a home and as a result they are registering flat to falling prices. Meanwhile cities like Bristol and Bournemouth are starting to register slower growth as affordability pressures increase. Higher prices and a further drift upwards in mortgage rates means that these affordability pressures will continue to steadily build. However, there are many cities where affordability remains attractive and prices are expected to continue their upward trend.”