House price growth stalls in southern cities as sellers start to accept larger discounts from asking prices

– Annual house price inflation in Southampton, Portsmouth and Bristol falls below 5%, as growth slows across southern cities

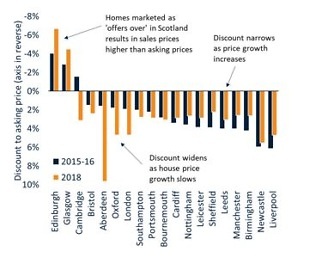

– Discounts from asking prices greatest in Aberdeen and London and increasing in cities across southern England as affordability pressures increase

– Large regional cities continue to register above average house price growth with sellers getting the smallest discount to asking prices

The latest Hometrack UK Cities House Price Index reveals that sellers in southern England are having to accept greater discounts on their asking prices to achieve a sale while in the midlands, northern regions and Scotland stronger market conditions means the gap between asking and sales prices is shrinking (figure 1).

In the south of England, the largest discounts are in London, Oxford and Cambridge, of up to 4.7% (see figure 2), but the latest data reveals the gap is starting to increase in Bristol, Portsmouth and Southampton as affordability pressures increase.

One anomaly to this southern trend is Aberdeen, which has the largest discounts from asking price of almost 10% (9.6%). Over the last year prices have fallen by 7.2% in the city and by almost 20% since 2014 when the price of oil went into reverse and impacted the economy, and demand for housing.

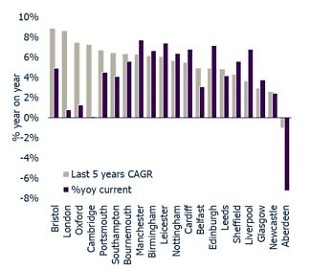

Overall city house price inflation has slowed to +4.9% in April with average values in London increasing by just 0.8% over the last 12 months. This has been compounded by below average growth in cities across southern England, such as Southampton, Portsmouth and Bristol where house price growth has slowed compared to the average rate of price gains over the last 5 years (figure 2).

The strongest house price growth is being registered in Manchester (7.7%), followed by Leicester (7.4%) and Edinburgh (7.2%). These cities are all recording house price growth that is higher than the average over the last 5 years supported by attractive affordability levels.

Sellers in these, and other cities outside southern England, are achieving a smaller discount to asking prices compared to 2 years ago, pointing to further above average house price growth ahead. Birmingham and Manchester have the smallest average discounts to asking price in England at 2.6%.

These cities have not been hit by external economic factors that have weakened demand in southern England, such as affordability pressures, tax changes and Brexit uncertainty. As a result, sellers in large cities outside of the South of England are getting smaller discounts to the asking price to achieve a sale.

Richard Donnell, Insight Director at Hometrack says: “The strength of house price growth and level of discounting from asking prices reveals how the current housing cycle continues to unfold. The overall pace of overall city level growth has lost momentum as a result of virtually static prices in London and slower growth across southern England.

Weaker consumer confidence and modest increase in mortgage rates are also impacting demand and mortgage approvals for home purchase have drifted lower in the last quarter. The cities index reveals, how macro and local factors such as the strength of the local economy and the relative affordability of housing are influencing the pace and direction of house price growth.”

Figure 1 – Hometrack UK cities house price index – growth rates over 1 and 5 years

Source: Hometrack UK Cities House Price Index

Figure 2 – Discount/premium to asking prices – 2018Q1 compared to 2015-16 average

Source: Hometrack/Zoopla

Figure 3 – 1 year growth compared to average over 5 years

Source: Hometrack/Zoopla